Calculating labor costs begins with a straightforward formula: hours worked multiplied by hourly rate. For simple operations, this approach works well enough.

In practice, most specialty contractors operate at a different scale. Fifteen jobsites across three states. Two hundred workers – a mix of W2 employees, temporary labor, and hourly subcontractors. Prevailing wage requirements that vary by jurisdiction and labor laws. Multi-state overtime calculations. Burden rates that shift by worker classification.

The formula itself isn’t the challenge. The reliability of the accurate data feeding that formula is where accuracy breaks down.

Consider common structural limitations: A worker arrives at 7:15 and departs at 3:30, but the timesheet shows “8 hours” because that’s how the form is designed. A temporary labor agency submits an invoice for “40 hours per worker” with no timestamp detail because their system doesn’t capture it. Time entries are often created after the fact, based on memory rather than verified start and stop times. Small or large estimation errors compound across hundreds of workers and multiple pay periods, creating meaningful labor cost variance.

According to industry research, labor represents 20-40% of total project costs for most contractors, and can reach 60% for specialty contractors performing self-perform work. When time data is captured after the fact or lacks independent verification, accurate job costing becomes harder to maintain.

When hours are captured late or without verification, the errors don’t stay in timekeeping. They show up in job costing, estimating, productivity reporting, and financial decisions across the portfolio.

This guide examines what actually comprises labor costs, how to calculate and track labor costs with accuracy, and – most importantly – the workforce data requirements that enable construction labor tracking at scale. Because calculation accuracy depends entirely on measurement accuracy.

What Are Labor Costs in Construction?

True labor costs extend beyond wages. They include wages, burden, and indirect costs. Understanding this structure is fundamental to accurate cost tracking and the ability to control labor costs effectively.

Direct Labor Costs: What You Pay Workers

Direct costs typically include:

- Base wages (varies by trade and classification)

- Payroll taxes (FICA, Medicare, unemployment – approximately 7.65% plus 1-2% for state unemployment)

- Workers compensation insurance (varies widely, typically 8-40% depending on trade and state risk classifications)

- Health insurance and benefits (commonly $3-8/hour for most construction companies)

- Union dues and fringes (typically $15-25/hour on union projects)

A worker earning $25/hour in base wages often costs $33-40/hour when fully burdened. This burdened labor rate – not the base rate – should inform job costing calculations and cost projections for specific projects.

Indirect Labor Costs: The Hidden Components

Indirect costs often include:

- Supervision and management allocation

- Training and onboarding (new workers require time to reach full productivity on specific tasks)

- Mobilization time (transit to and from job sites)

- Non-productive time (weather delays, material shortages, required safety meetings)

- Rework costs (paying a second time for the same work)

Many construction businesses have reasonable visibility into direct costs but limited tracking of indirect costs and project expenses incurred. This gap can represent 20-30% of actual labor costs – a significant contributor to budget variance that often goes unmeasured throughout the construction process.

All of these calculations depend on the quality of the underlying time data. When hours are captured inconsistently or lack independent verification at the jobsite, labor cost calculations become less reliable.

Base Rates vs. Burdened Rates: Why Your Calculation May Be Incomplete

Base rate represents what you pay the worker directly. Burdened rate represents the full cost to employ that worker for one hour – this is the figure you need for accurate financial projections and to effectively track labor costs.

Industry data suggests burden adds 25-50% to base rates. For most specialty contractors, burden typically runs 35-45%.

Example breakdown:

- Base rate: $30/hour

- Burden: 40%

- Burden cost: $30 × 0.40 = $12/hour

- Burdened rate: $42/hour

Consider a project estimate:

- Scope: 2,000 labor hours

- Calculation using base rate: 2,000 × $30 = $60,000

- Actual burdened cost: 2,000 × $42 = $84,000

- Difference: $24,000 (40%)

Apply a 15% markup for project management:

- Bid using base rate: $60,000 × 1.15 = $69,000

- Bid using burdened rate: $84,000 × 1.15 = $96,600

- Revenue gap: $27,600

Scale this across 20 projects annually: approximately $552,000 in underestimated labor costs affecting your project budget on future projects.

But there’s a second challenge. Even contractors who consistently apply burdened rates face accuracy issues if the underlying hours contain systematic variance. If actual hours were 2,200 instead of 2,000 (due to rounding practices, delayed entries, or gaps in verification), your estimated cost of $84,000 becomes an actual cost of $92,400 – potentially consuming your expected profit margin with additional costs you didn’t anticipate. This can affect your construction project’s financial health in an unexpected way.

The burden calculation itself is straightforward. Obtaining reliable, accurate data to burden is where most systems face limitations, which is why construction cost tracking requires verified time data from real time cost tracking systems.

3 Methods Contractors Use to Calculate Labor Costs

All three methods depend on accurate historical labor cost data. Each method produces less reliable results when that data contains systematic variance or lacks consistent verification.

Method | How It Works | Example | Best For | Key Risk |

Bottom-Up Estimating | Estimate hours per task × labor rate | Conduit: 800 hrs × $49.70 = $39,760 Wire: 600 hrs × $49.70 = $29,820 Total: $84,980 | Large projects, T&M work, detailed job costing | Inherits variance from imprecise historical productivity rates |

Percentage Method | Apply labor % to total project cost | $500,000 × 35% = $175,000 | Conceptual estimates, early budgets | Reflects industry norms, not your actual costs |

Unit Rate Method | Historical cost per unit of work | 10,000 sqft × $2.75/sqft = $27,500 | Repetitive work, rapid estimates | Unit rate precision depends on underlying data quality |

Method 1: Bottom-Up Estimating (Task-by-Task)

Break the project into discrete tasks, estimate hours per task, and apply burdened rates – essential for construction estimating software to produce reliable outputs.

Example:

- Conduit installation: 800 hours × $49.70 = $39,760

- Wire pulling: 600 hours × $49.70 = $29,820

- Device rough-in: 400 hours × $38.50 = $15,400

- Total: $84,980

When to use: Large projects, T&M work requiring backup documentation, situations requiring detailed job costing for specific tasks.

Data dependency: Bottom-up estimating relies on historical labor productivity rates. If those rates were derived from time records that lacked precision (for example, 0.5 hours per 100 feet when actual productivity varied between 0.45 and 0.55), the estimate inherits that variance. This can lead to bids that are either less competitive or less profitable than intended on future projects.

Method 2: Percentage Method (Industry Benchmarks)

Apply a labor percentage to total project costs to establish the project budget.

Example:

- Total project cost: $500,000

- Labor percentage: 35%

- Labor cost: $175,000

When to use: Conceptual estimates, feasibility studies, early budget development for the entire project.

Data dependency: Construction industry averages provide general guidance, but your specific percentage may differ based on crew composition, equipment usage, and operational approach. Without accurate historical cost data from your own specific projects, percentage-based estimates reflect industry norms rather than your actual cost structure.

Method 3: Unit Rate Method (Cost Per Unit)

Use historical cost per measurable unit of work to track labor costs.

Example:

- Drywall: 10,000 sqft × $2.75/sqft = $27,500

When to use: Repetitive work, productivity comparisons, rapid estimates.

Data dependency: Unit costs only work when based on verified productivity data. Without accurate time records, you don’t know if $2.75/sqft reflects 1.2 hours or 1.5 hours per 100 sqft – a significant variance when applied across multiple projects. The unit rate appears precise, but its accuracy depends entirely on the quality of the underlying labor data and proper financial management practices.

The pattern across all three methods: Most construction companies struggle to use any method with full confidence because historical data quality varies. Past costs reflect whatever time tracking approach was in place, and if that approach had structural limitations – delayed entry, rounding practices, limited verification – those limitations carry forward into every future estimate prepared using construction estimating software.

How to Calculate Labor Costs: 5 Essential Steps

The following example uses realistic figures for an electrical contractor with a 40-worker crew on a commercial project.

Step 1: Gather Your Labor Data

Worker rates and burden:

- Journeymen: $38/hour base + 42% burden = $53.96/hour

- Apprentices: $28/hour base + 38% burden = $38.64/hour

- Foremen: $45/hour base + 40% burden = $63/hour

Project scope:

- 16 weeks, 40 workers, 40 hours/week

- Total estimated: 25,600 hours

Data considerations: Effective labor cost calculation depends on having organized burden rates by classification and reliable historical labor cost data from specific projects. Many contractors maintain rates in payroll systems but update burden calculations infrequently. Outdated burden rates can create meaningful variance in cost projections, particularly when insurance rates or benefit costs have changed, affecting your ability to control labor costs.

Step 2: Calculate Direct Labor with Burden

- Foremen (4 × 640 hours): 2,560 hours × $63 = $161,280

- Journeymen (20 × 640 hours): 12,800 hours × $53.96 = $690,688

- Apprentices (16 × 640 hours): 10,240 hours × $38.64 = $395,674

- Total direct labor: $1,247,642

Data considerations: This calculation assumes precise visibility into who worked how many hours at each job site. When time data contains systematic variance – whether from rounding practices, delayed entry, or limited verification – the impact compounds across large crews and extended projects. A 5% variance in reported hours would shift this figure by approximately $62,000, which can represent a material portion of expected margin on projects with tight budgets, undermining accurate job costing.

Step 3: Add Indirect Costs

- Project management: 320 hours × $75 = $24,000

- Training (estimated 2% of production): 461 hours × $50 = $23,050

- Non-productive time (estimated 5%): 1,280 hours × $50 = $64,000

- Indirect labor: $111,050

- Total project cost: $1,358,692

Data considerations: Indirect cost allocation typically relies on percentage-based estimates when direct measurement isn’t feasible. The 5% non-productive time figure in this example is illustrative. Actual non-productive time varies by project conditions, weather, coordination requirements, and material availability. Without measurement systems that track these factors throughout the construction process, indirect costs and expenses incurred remain estimated rather than known.

Step 4: Factor in Variables

- Weather impact: $46,100

- Site logistics: $64,000

- Learning curve: $25,600

- Variable additions: $135,700

- Running total: $1,494,392

Data considerations: Correlating labor productivity to specific conditions – weather, site access, crew experience – requires timestamped accurate data that shows when work occurred. Without that temporal context, it becomes difficult to distinguish between different types of cost variance and apply appropriate adjustments to future projects, weakening overall project management capabilities.

Step 5: Apply Overhead and Monitor Ongoing

- Overhead (12%): $179,327

- Contingency (6%): $89,664

- Total with overhead: $1,763,383

Critical consideration: Labor cost calculation is not a one-time exercise – it’s an ongoing process throughout the project lifecycle. Effective cost management depends on frequent comparison of actual labor consumption to planned project budget. Weekly variance analysis allows teams to identify emerging issues while corrective action is still practical. Discovering significant labor variance late in the project limits available responses and reduces the effectiveness of course correction for the entire project.

Requirements for effective ongoing management: Accurate daily time data from a time tracking solution, integration between time tracking and job costing systems, dashboards showing hours consumed relative to budget, and automated alerts at predetermined thresholds (commonly 75% of planned budget) to enable intervention before variance becomes unrecoverable – supporting real time cost tracking and financial management.

How Does Labor Tracking Impact Construction Project Profitability?

Consider realistic numbers for a mid-size specialty contractor: 200 workers, $40/hour average burdened rate, 2,080 hours annually per worker.

Scenario: 5% time tracking variance (a conservative estimate accounting for rounding practices, delayed entry, and limited verification)

- Annual payroll: 200 × 2,080 × $40 = $16,640,000

- 5% variance: $832,000 in labor cost uncertainty

This initial figure affects multiple downstream processes throughout the construction process:

Job costing impact: Projects reflect labor costs that include the 5% variance. When you believe labor cost $500,000 but actual productive hours may have been $475,000, profitability analysis and financial management decisions are based on that discrepancy, affecting accurate job costing.

Estimating impact: Bids built on historical hours that contain variance create two possible outcomes: estimates that are either less competitive (when variance inflates historical productivity) or less profitable (when variance obscures actual productive requirements) on future projects.

Productivity analysis impact: True labor productivity becomes difficult to identify when hours contain systematic variance. Distinguishing between genuine performance differences and measurement inconsistency requires accurate data that’s captured uniformly across crews on specific tasks.

Resource allocation impact: Staffing decisions for specific projects rely on labor data. When that data contains variance, resource allocation reflects those inaccuracies. You may allocate 15 workers when actual productive capacity is closer to 14.2 workers – an inefficiency that compounds across multiple projects, affecting overall project management.

Three-year compound effect:

- Year 1: $832,000 variance

- Year 2: Estimates based on Year 1 data (already containing variance), perpetuating another $832K plus margin pressure from competitive dynamics

- Year 3: Two years of data containing variance, reducing estimating reliability further on future projects

Total: Approximately $2.5M+ in direct impact, plus difficult-to-quantify indirect effects from operational decisions based on incomplete data – lost cost savings opportunities.

Industry research suggests time-related variance costs contractors approximately $4,285 per worker annually. For 200 workers: $857,000/year from time variance alone, not accounting for unintentional errors – costs that could otherwise improve profit margins and cash flow, representing significant potential cost savings.

Benefits of Effective Labor Tracking in Construction Projects

1. Crew Performance Cost Management Insights

Compare labor productivity on identical work. With accurate tracking by crew and cost codes on specific tasks:

- Crew A: 0.07 hours per linear foot of conduit

- Crew B: 0.09 hours per linear foot

- Crew B performs 29% slower

This visibility allows investigation into root causes. Training requirements? Different methodology? Coordination affecting workflow at the job site?

ROI calculation: Improving Crew B from 0.09 to 0.08 hours saves 0.01 hours per foot. On 50,000 linear feet: 500 hours saved. At $54/hour burdened rate: $27,000 from one productivity improvement – demonstrating measurable cost savings.

2. Multi-State Compliance (Automated)

California requires specific prevailing wage rates. Texas has different requirements. Arizona varies by project type. Union contracts add additional layers governed by labor laws – some requiring double-time after 8 daily hours, others after 40 weekly hours.

Without automation: Manual application of varying rules increases error probability, which can result in penalties and back-pay obligations, introducing unbudgeted labor costs.

With construction cost tracking software: Systems apply rates automatically based on project location, worker classification, day of week, and applicable labor laws.

ROI: A single prevailing wage compliance issue on a $2M project can result in penalties exceeding $50,000. Automated compliance reduces this exposure, helping to avoid budget overruns.

3. Temp Labor and Subcontractor Accountability

A temporary labor agency invoices for “2,000 hours” at $35/hour = $70,000. Independent verification provides a basis for comparing invoiced hours to actual recorded hours – helping to track labor costs accurately and identify additional costs.

With independent verification: Temporary labor and subcontractor hours are captured using the same check-in system as direct employees at the jobsite. Verified timestamps and identity records create a consistent, independent source of truth for all hourly labor. When billed hours differ from verified records, discrepancies can be reviewed and resolved with documentation rather than assumptions.

Industry example: Syber Concrete Forming, a 300-person concrete contractor, implemented biometric time tracking to address recurring time discrepancies across both employees and hourly subcontractors. Prior to automation, payroll teams spent more than 10 hours per week reconciling paper timesheets and subcontractor invoices.

After implementing SmartBarrel, Syber reduced manual timekeeping for subcontractors by 60%, cut payroll processing time by 80%, reduced payroll errors by up to 30%, and identified approximately $1 million in time discrepancies within the first year.

ROI implication: For contractors managing large mixed workforces, independent time verification improves accuracy, reduces administrative effort, and provides defensible documentation for labor reconciliation and billing, particularly at scale.

4. T&M Billing Confidence

You invoice a general contractor for $75,000 labor. GC questions $15,000: “We need verification that all invoiced workers were actually on-site during reported hours.”

Without independent verification: You provide timesheets signed by supervision. GC questions their completeness. Discussion occurs. You may settle for $65,000, absorbing $10,000 in expenses incurred.

With biometric verification: Facial-verified timestamps, geo-stamps, and photo evidence create an independent record of accurate data. You provide the GC a report showing exactly who was on the job site and when. Discussion typically resolves in your favor when documentation is clear, supporting accurate job costing and real time cost tracking.

Case study: Dynamic Systems Inc. (DSI), a mechanical contractor with 2,500+ workers, identified $2.6M in time variance after implementing biometric time tracking – not all intentional, but variance that was affecting their cost tracking accuracy across the entire project portfolio.

What Are The Main Challenges of Construction Labor Tracking?

Construction labor tracking typically faces several recurring operational constraints. These challenges show up consistently across projects and organizations, regardless of contractor size or trade specialization, affecting the ability to track labor and control labor costs effectively.

1. Time Variance and Verification Gaps

The structural issue: When time capture systems lack independent verification at the job site, small inaccuracies can accumulate into material cost variance. Common sources include inconsistent rounding practices (workers arrive at 6:58 and 7:43, both times become 7:00), delayed entry (hours recorded from memory at week’s end), and limited identity verification (workers clocking in and out for each other).

The impact: Industry research suggests that time variance creates overpayment of approximately $4,285 per worker annually. In labor-intensive operations with 200 workers, that exposure can approach $857,000 per year – affecting both direct payroll costs and the reliability of accurate data used for accurate job costing on future projects.

Why it occurs: Paper timesheets lack verification mechanisms. Fob systems can be shared. Mobile apps that rely on location services alone verify where a device is, not who’s holding it. Any system that cannot independently confirm worker identity and location creates an environment where time data accuracy depends primarily on trust rather than verification, undermining real time cost tracking.

2. Manual Data Entry and Multi-Step Processing

The structural issue: Time data that moves through multiple manual steps – handwritten timesheets, office transcription, system entry – introduces opportunities for transcription errors, data loss, and delays between field activity and financial visibility throughout the construction process.

The impact: Research on manual data entry suggests error rates of 1-4%. Applied to labor cost data, this means 1-4% of your payroll information may contain errors. On a $10M annual payroll, that represents $100K-$400K in potential data variance affecting job costing, construction estimating software, and financial management decisions.

Why it occurs: Workflows designed around forms and batch processing rather than real-time capture. Disconnected systems that don’t share accurate data automatically. Field teams being asked to perform administrative tasks that would be better handled through automated data flow from a time tracking solution. Project managers spending time reconciling conflicting records rather than managing project delivery.

3. Multi-Company Workforce Verification

The structural issue: Managing labor costs becomes more complex when work is performed by multiple organizations. In addition to direct employees, many projects rely on temporary labor from staffing agencies and hourly subcontractors for specific tasks. While these arrangements are common and often operationally necessary, they introduce additional verification requirements when billed hours cannot be independently confirmed at the job site.

The operational reality: In multi-company workforce environments that combine W-2 employees, temp labor, and subcontracted crews, cost tracking depends on verification methods that work consistently across all worker types on specific projects. Without that consistency, labor reporting becomes fragmented and cost variance can accumulate without clear visibility into its source, creating systematic labor cost variance that compounds across projects.

Why it occurs: Reliance on summarized invoices, verbal confirmations, or timesheets submitted by third parties limits transparency. When there is no independent system to confirm who was on-site and when work occurred, validating billed hours becomes difficult and billing discussions become more likely, affecting overall project management.

4. Multi-State Regulatory Complexity

The structural issue: Managing projects across multiple states introduces significant operational complexity. Jurisdictions like Texas, Florida, and California each have different prevailing wage requirements, union agreements, and overtime calculation rules governed by different labor laws. Cost tracking systems must account for these variations automatically. When they do not, compliance risk increases and labor costs become harder to model accurately across geographies, threatening the project budget.

The impact: Errors in prevailing wage calculations can lead to back pay obligations and financial penalties, leading to back-pay liability, penalties, and compliance-related cost exposure. Simultaneously, applying incorrect labor burdens distorts job cost data and weakens confidence in profitability analysis. Together, these issues introduce financial risk that often becomes apparent only after projects are substantially complete on the entire project.

Why it occurs: Many systems are designed for single-state operations. Manual rule tracking, spreadsheet-based adjustments, and limited automation make it difficult to apply jurisdiction-specific labor laws consistently across a multi-state project portfolio, undermining financial management.

5. Delayed Cost Visibility

The structural issue: Traditional time tracking workflows introduce delays between field activity and financial visibility. Time captured throughout the week, collected on Friday, processed early the following week, and reflected in job costing reports several days later creates a 7-14 day lag between when work occurs and when cost performance becomes visible, preventing real time cost tracking.

The impact: When cost variance takes a week or more to surface in reports, the window for effective intervention narrows significantly. If a project consumes 20% more labor hours than budgeted in the project budget, a two-week reporting delay means two weeks of compounding variance before teams can respond – lost opportunities for cost savings.

Why it occurs: Batch processing workflows. Manual data collection and entry cycles. Time tracking systems that operate independently from job costing platforms. Lack of real-time integration between field data capture and financial reporting systems – systems not designed to track labor costs effectively.

6. Foreman Administrative Burden

The structural issue: In many time tracking workflows, foremen are responsible both for crew leadership and for time documentation. This dual responsibility creates operational tension. Foremen need to keep crews productive and motivated while also being responsible for documenting attendance, hours, and cost codes for specific tasks – tasks that require different skill sets and competing time commitments throughout the construction process.

The impact: When time documentation depends heavily on foremen, accuracy becomes difficult to maintain during busy periods or when coordination challenges arise at the job site. The administrative burden can reduce the time foremen spend on their primary role: managing work quality, crew safety, and project progress – affecting overall project management.

Why it occurs: Time tracking systems designed around forms and manual entry naturally place documentation responsibility on supervision. Without automated data capture at the worker level using a time tracking solution, someone must manually record and organize time information – and that responsibility typically falls to foremen, limiting their ability to focus on labor productivity.

7. Integration and Data Flow Constraints

The structural issue: Time data captured in one system, job costing performed in another, payroll processed separately, and ERP maintained independently. Manual export and import processes create lag, introduce transcription errors, and require ongoing reconciliation between systems that don’t share accurate data automatically.

The impact: Decision-making speed decreases when data is scattered across disconnected systems. By the time information is manually compiled into a coherent view, the moment for timely intervention may have already passed. Cost visibility becomes retrospective rather than actionable, preventing effective financial management and the ability to control labor costs across future projects.

Why it occurs: Best-of-breed tool selection without considering integration requirements. Legacy systems with limited API support. Lack of middleware or integration platforms connecting disparate systems. Project managers spending time reconciling data rather than analyzing performance – unable to track labor effectively across the entire project.

Manual vs. Automated Labor Tracking: What Works for Your Workforce

Different time tracking approaches serve different operational needs. The appropriate choice depends on workforce size, project complexity, and verification requirements for specific projects.

Manual (Paper/Foreman Entry)

Appropriate for: Owner-operated companies, operations with under 10 workers, single-project environments, simple rate structures without complex burden calculations.

Structural limitations at scale: Manual approaches face increasing challenges as operations grow. Multiple concurrent projects, mixed workforce types (direct employees, temporary labor, hourly subcontractors), prevailing wage requirements governed by labor laws, union rules, and multi-state operations introduce complexity that manual processes struggle to handle consistently.

These systems depend on memory, manual calculation, and delayed data entry – constraints that become more significant as workforce size and project count increase. Time splitting across specific projects becomes difficult to track accurately, and T&M documentation lacks independent verification. Administrative burden increases substantially for field supervision, and the inability to track labor costs in real time limits financial management capabilities.

Mobile-Only (Apps, GPS)

Appropriate for: Small mobile crews (typically under 20 workers), operations where all workers have smartphones, areas with reliable cellular coverage.

Structural limitations at scale: Mobile-only time tracking app approaches face challenges with larger crews, temporary labor (who may not download company apps), workers without smartphones, and indoor or underground locations with limited coverage. GPS verification confirms device location but not worker identity at the job site.

Offline sync capabilities introduce delays between when work occurs and when data becomes available for cost tracking, preventing real time cost tracking. For T&M billing requiring independent verification, location data alone may not provide sufficient accurate data. These limitations affect the ability to track costs effectively and control labor across multiple construction sites.

Hardware + Software (SmartBarrel)

How it works: Physical time clock devices installed on job site. Workers check in using phone number and facial verification. Built-in cellular connectivity. Data flows to dashboard supporting real time cost tracking.

Workforce coverage: Supports verification across direct employees, temporary labor, and hourly subcontractors using consistent standards within a single system – essential for accurate job costing on specific projects.

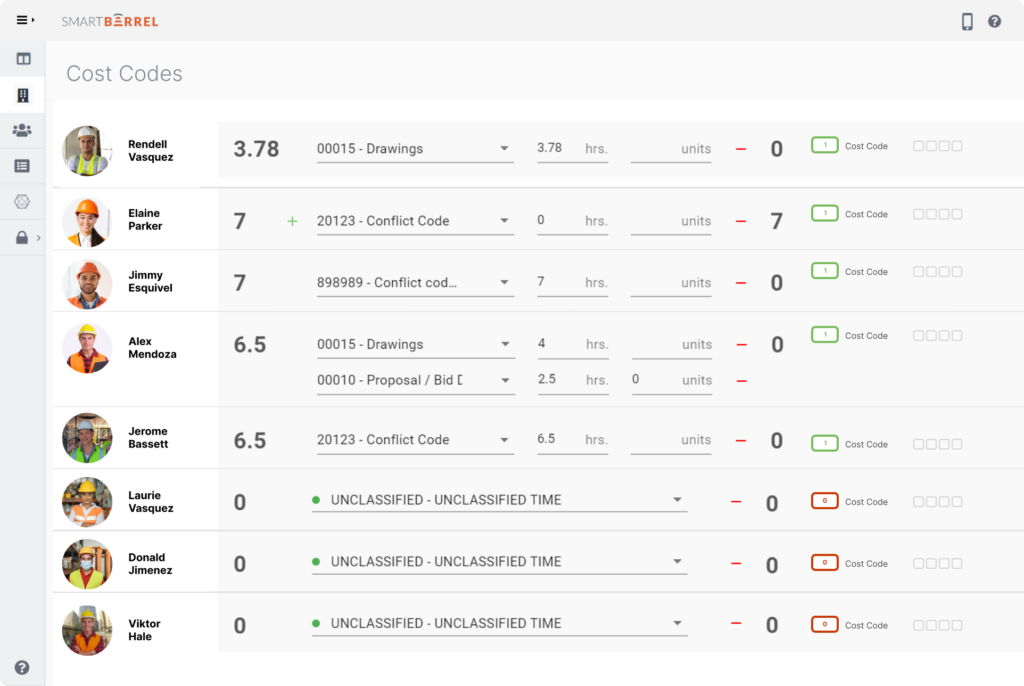

Field supervision workflow: Workers self-check-in at the device level. Time data flows into pre-populated timesheets. Foremen and project managers review verified records and assign cost codes for specific tasks, reducing administrative burden and improving data accuracy while allowing focus on labor productivity.

T&M documentation: Each clock-in captures facial-verified photo, timestamp, and geo-location – accurate data creating independent record supporting billing verification and addressing common documentation requirements.

Field conditions: Operates without requiring workers to have phones (fob option available). Does not depend on WiFi (uses built-in LTE). Works with PPE- gloves, hard hats, glasses. . Can be powered by solar, electric, or battery. Typical installation requires minimal setup time at any job site.

Cost and productivity visibility:

Dashboards update in real time to support labor cost tracking and productivity insight. Teams see live headcount across multiple projects, labor hours consumed relative to budget, and how those hours translate into work completed. This enables earlier detection of productivity drift and cost variance before issues compound.

Integration capability: Connects with project management and ERP platforms including Procore, CMiC, Viewpoint Vista, supporting automated data flow for payroll, job costing, and financial reporting – enhancing construction estimating software and overall project management with accurate data throughout the construction process.

Best Practices for Labor Cost Accuracy

Effective labor cost tracking depends on consistent operational practices that support data accuracy and timely visibility. The following approaches have proven reliable across different contractor types and project scales for maintaining financial management and the ability to control labor costs.

System-Verified, Worker-Initiated Time Capture

The practice: Design time capture so each worker initiates their own clock-in and clock-out, while the system independently verifies the punch through identity, time, and location validation.

Why it helps: This approach removes reliance on supervision and memory while preserving accountability. Workers are responsible for clocking in and out, but the system validates each punch using facial verification, timestamps, and jobsite location context. Foremen are no longer responsible for reconstructing attendance, and labor records are supported by objective verification rather than trust alone. The result is more accurate labor data, lower administrative burden, and stronger support for job costing, productivity tracking, and billing.

Automate Burden Rate Calculations

The practice: Configure burden rates by worker classification within your construction estimating software. Update rates quarterly or when insurance, benefits, or tax rates change. Apply burden automatically to labor hours rather than through manual calculation.

Why it helps: Automated burden application reduces calculation errors and ensures consistency across specific projects. When burden rates are maintained centrally and applied systematically, job costing and estimating rely on current, accurate fully-burdened labor costs, supporting better financial management and the ability to track labor costs accurately.

Track Crew Productivity by Task

The practice: Compare crew performance on identical or similar specific tasks across projects. Use verified accurate data and cost codes to measure hours per unit of work completed.

Why it helps: Productivity comparison identifies variation in crew performance and supports targeted training or process improvements. When differences emerge, teams can investigate root causes – methodology, coordination, site conditions – and address them systematically, improving financial control and identifying cost savings opportunities for future projects.

Verify Temp and Sub Hours Independently

The practice: Apply the same verification standards to temporary labor and hourly subcontractors that you use for direct employees at each job site.

Why it helps: Independent verification provides a basis for validating billed hours against actual verified time. Industry data suggests billing variance of 5-15% is common when hours cannot be independently confirmed. For operations spending $1M annually on temporary labor, verification can recover $50K-$150K in billing adjustments – significant cost savings by preventing additional costs from going undetected.

Real-Time Cost Code Assignment

The practice: Assign cost codes daily as work occurs on specific tasks, using verified time records from real time cost tracking systems, rather than struggling to allocate cost codes at week’s end.

Why it helps: Real-time assignment improves accuracy by reducing reliance on memory throughout the construction process. For repetitive work, systems that remember recently-used cost codes or suggest carry-over assignments reduce friction and improve consistency, supporting accurate job costing across the entire project.

Build for Multi-State Operations

The practice: When operating across multiple states, implement systems that handle prevailing wage requirements, state-specific overtime rules, and jurisdiction-based labor laws automatically.

Why it helps: Automated rule application reduces compliance risk and improves cost modeling accuracy across geographies. Manual tracking of jurisdiction-specific requirements becomes increasingly difficult as project count and geographic footprint expand. Compliance issues can result in penalties exceeding $50,000 on individual projects – unexpected additional cost overruns that affect the project budget and overall project management.

Provide Role-Based Visibility

The practice: Structure labor and cost data access based on operational role, so each team sees the information they need to make decisions without unnecessary complexity.

Why it helps: Different roles interact with labor data in different ways:

- Foremen and superintendents manage daily attendance, review verified punches, and assign cost codes as work is performed

- Payroll teams receive clean, verified, payroll-ready time data without chasing missing hours or correcting discrepancies

- Project managers monitor labor costs and productivity by cost code compared to project budget, using data captured and verified in the field

- Leadership reviews labor performance across projects with alerts for emerging variance

- Estimators rely on historical labor productivity and unit cost data to improve future bids

Role-based visibility ensures each group gets accurate, timely information aligned with how work actually happens, reducing rework and improving labor cost control across the organization.

Construction Labor Cost Tracking FAQs

How to track construction work?

Labor cost tracking forms the foundation of construction cost management. Effective approaches typically include real-time attendance verification at the job site, daily cost code assignment at the worker level for specific tasks, labor productivity measurement, and consolidated visibility when workers move between specific projects.

Systems like SmartBarrel support this through biometric check-in. Workers verify their identity on-site using facial verification, and time data is captured automatically and flows directly into labor tracking and job costing workflows. That verified labor data then integrates with project management platforms like Procore, supporting comprehensive labor tracking expenses incurred and project progress throughout the construction process, enabling real time cost tracking and effective overall project management.

How to track construction costs?

Accurate labor cost calculation requires several data elements to track labor costs effectively: verified hours (base accurate data), correct rates (base wage plus burden by classification), proper cost code allocation for specific projects, and timely visibility into cost performance relative to project budget.

Workforce complexity affects labor tracking requirements. Direct employees, temporary labor, and subcontractors often require different approaches. Union versus non-union workers have different regulatory requirements governed by labor laws. Multi-state operations face varying prevailing wage rates and compliance obligations. Effective systems account for these variables systematically rather than through manual adjustment, supporting accurate job costing and financial management.

How do you handle tracking job costs and overhead on projects?

The labor component of job costing typically includes direct labor costs (hours multiplied by burdened rate, organized by cost code for specific tasks), indirect expenses incurred (supervision, training, mobilization), and appropriate overhead allocation (commonly time-based).

Common accuracy challenges include using base rates instead of fully-burdened rates, inconsistent cost code assignment, untracked non-productive time, and delayed cost recognition. Effective practice involves capturing labor hours with verified cost codes in real-time at the job site, applying burden rates automatically by classification using construction estimating software, and maintaining daily visibility into labor costs per project to support timely course correction – essential for controlling labor costs and achieving cost savings throughout the entire project.

How do you keep track of construction projects?

Labor tracking is a critical component of overall project management, operating alongside schedule management and budget monitoring. Effective project tracking typically requires real-time headcount visibility at each job site, comparison of actual labor hours to scheduled hours, and labor productivity trend analysis.

The multi-project challenge: Operations managers cannot be physically present on every jobsite simultaneously, but still require consolidated visibility to track labor across specific projects. For contractors managing 15 projects with 200 workers, real-time labor status across the portfolio becomes essential for effective resource allocation and early issue identification, supporting financial management and the ability to control labor costs across future projects.

What's the best way to track jobsite labor costs in real time?

Real time labor cost tracking typically requires several integrated capabilities to track labor costs effectively and maintain accurate data:

Verified worker identity: Biometric facial verification ties each time entry to a specific individual at the job site, addressing buddy punching concerns across direct employees, temporary labor, and subcontractors – supporting accurate job costing.

Immediate data transmission: Built-in cellular connectivity transmits time data as it’s captured, rather than storing for batch upload. This supports near-immediate visibility rather than delayed reporting, enabling real time cost tracking.

Automatic burden rate application: Systems that know worker classification can apply correct burdened rates automatically, providing true labor cost visibility rather than base-wage-only reporting – essential for accurate financial management.

Real-time cost code assignment: Pre-populated timesheets enable one-click cost code assignment for specific tasks, supporting accurate classification without extensive manual effort throughout the construction process.

Multi-project consolidation: Centralized dashboards show all workers across all active sites, current project costs, and labor consumption relative to project budget – enabling teams to identify additional costs and achieve cost savings.

The SmartBarrel approach: Workers check in via TimeClock 4.0 without requiring phones. Built-in LTE transmits accurate data immediately. The system captures all data points automatically per clock-in. Project managers assign cost codes using verified records with minimal clicks. Data flows to ERP and payroll systems supporting real time cost tracking. Live dashboards show current costs across all projects.

At 9am Tuesday, operations teams can see which workers are on-site across 15 projects, hours consumed during the current week, current costs compared to project budget, and project status. This visibility supports timely intervention when variance emerges, rather than discovering issues days or weeks later through delayed reporting – enabling effective financial management, the ability to control labor costs, and identification of cost savings opportunities before small problems compound into material budget impact across the entire project.

Ready to improve your labor cost tracking and financial management?

Many construction businesses still rely on manual timesheets and memory-based entries that create systematic variance in labor costs. That variance compounds forward into construction estimating software, job costing, and financial decisions across future projects.

See how SmartBarrel delivers verified time data from the job site with biometric facial verification – construction cost tracking built specifically to track labor costs accurately. Monitor your project budget in real-time, maintain accurate job costing, and make timely adjustments before cost variance impacts the entire project. Achieve measurable cost savings, reduce additional costs from time variance, and control labor costs effectively with real time cost tracking that supports better financial management and overall project management.

Request your demo today and see how accurate data transforms labor productivity, enables cost savings, and strengthens your ability to deliver future projects on budget.