Construction cost tracking fails for a reason that rarely shows up in project post-mortems: data quality. Understanding the difference between construction hard costs and soft costs matters, but only when the numbers feeding your categories are reliable. Project management software and job costing platforms can be powerful tools – when the field data entering them is accurate.

The distinction between hard and soft costs shapes how projects get financed, how risks get managed, and how profit margins hold up under pressure. Most construction professionals understand the basic categories. Building materials, labor, and equipment fall into hard costs. Building permits, insurance, and design and engineering fees fall into soft costs. The breakdown seems straightforward.

What’s not straightforward is maintaining accuracy across both categories. Material costs get tracked to the penny through purchase orders and invoices. Labor costs – representing 40-50% of hard costs – depend on measurement systems that may introduce 3-5% variance. That variance compounds across projects, affecting everything from job costing to future estimating.

This guide breaks down hard costs and soft costs with a focus on the operational requirements behind each category. Because knowing what belongs where only matters when your measurement systems support accuracy.

Construction Hard Cost vs Soft Cost

Hard costs and soft costs represent fundamentally different types of construction expenses, each requiring distinct management approaches.

Hard costs (often called brick and mortar costs) are direct expenses tied to physical building. These include building materials, labor, and equipment – anything that creates the actual structure. Hard costs typically represent 70-80% of a construction budget and are easier to quantify because they’re based on specific quantities and measurable work.

Soft costs are indirect costs necessary to complete the project but not directly tied to physical construction. These include architectural fees, building permits, insurance, financing costs, and construction project management. Soft costs typically represent 20-30% of total project costs and extend throughout the project lifecycle, from initial planning through post-construction.

The key differences exist because each category requires different approaches to budgeting, financing, and risk management. Lenders evaluate hard and soft costs using different criteria when approving construction financing. Hard costs are typically disbursed through milestone-based payments tied to construction progress. Soft costs often require invoice-based payments that continue throughout pre-construction, construction, and post-construction phases.

Understanding this distinction provides the framework for effective cost control. The challenge isn’t knowing which category an expense belongs to – it’s establishing measurement systems that capture accurate data for each.

Hard Costs in Construction

Hard costs represent the tangible, direct expenses that create physical structure. For specialty contractors, these costs break down into three primary categories: materials, labor, and equipment and site preparation.

Materials

Materials typically represent 30-40% of hard costs. This includes all raw building materials from structural components (lumber, steel, concrete, drywall) to finishing materials (paint, flooring, fixtures). It also covers consumables – the fasteners, adhesives, caulking, and other items that accumulate across a project. Purchase orders and invoices provide clear documentation for material costs, making this category relatively straightforward to track.

Labor

Labor represents 40-50% of hard costs and includes all wages and benefits paid to construction workers on the project. This covers your direct employees, temporary labor, and hourly subcontractors performing the actual construction work. Labor costs include base wages, overtime premiums, payroll taxes, workers’ compensation, and benefits.

Labor presents unique measurement challenges. Material costs flow through documented purchasing systems. Labor costs depend on time capture systems that may introduce variance depending on their design. Manual timesheets captured from memory at week’s end can introduce 3-5% variance. Delays between work performed and time recorded reduce accuracy. These small percentages compound across large crews and long projects.

Equipment and Site Preparation

Equipment and Site Preparation represents the remaining 15-25% of hard costs. This includes both owned and rented construction machinery (excavators, cranes, lifts), smaller equipment (scaffolding, generators, compressors), and site preparation work (excavation, grading, temporary utilities, access roads).

Equipment costs often include both direct usage (rental fees, fuel, operators) and indirect usage (maintenance, transportation, storage). Accurate equipment cost tracking requires understanding actual utilization, not just rental periods or ownership costs.

Factors Influencing Hard Costs in Construction Projects

Several variables affect hard cost accuracy and predictability across most construction projects:

Factor

What Drives It

Cost Impact

Material Price Volatility

Material price volatility creates the most visible cost pressure. Lumber, steel, and other commodity materials fluctuate based on market conditions. Projects with long timelines face exposure to price changes between estimation and purchasing. Material availability can force substitutions that affect both cost and schedule.

Labor

Labor availability and wage rates vary by market, trade, and project timing. Tight labor markets drive wage increases. Specialty trades command premium rates. Union versus non-union labor creates different cost structures. Overtime requirements – whether planned or driven by schedule pressure – significantly impact labor costs.

Site Conditions

Construction site conditions affect both productivity and cost. Difficult access increases material handling costs. Underground utilities require careful coordination. Weather impacts outdoor work and can drive schedule delays that compound costs. Remote locations increase transportation and logistics expenses.

Project Complexity

Project complexity drives cost through specialized labor requirements, coordination demands, and quality control needs. Complex mechanical systems, intricate architectural details, or tight tolerances all increase labor hours beyond basic square footage calculations.

The measurement challenge appears in the gap between estimated and actual costs. Material estimates based on quantities typically hold within 2-3% when purchasing happens on schedule. Labor estimates depend on productivity assumptions that may vary 10-15% based on construction site conditions, crew experience, and coordination effectiveness.

Because labor estimates swing with productivity and conditions, you need a field-to-office method to track labor costs accurately.

Time tracking systems that introduce variance affect labor cost accuracy. When hours are rounded to the nearest quarter hour, captured from memory, or entered in bulk by foremen, small inaccuracies compound. A 200-worker operation with 3% time variance can represent $50,000-$100,000+ in annual labor cost discrepancy.

Construction Hard Cost Examples

Here’s how hard costs typically break down for a commercial construction project:

Materials (35% of hard costs):

- Structural materials: concrete, rebar, structural steel (40%)

- Framing materials: lumber, metal studs, sheathing (25%)

- Mechanical and electrical materials: HVAC components, electrical panels, conduit, wire (20%)

- Finishing materials: drywall, flooring, paint, fixtures (15%)

Labor (45% of hard costs):

- Skilled trades: electricians, plumbers, HVAC technicians, carpenters (60%)

- General labor: helpers, material handlers, cleanup crews (25%)

- Specialty installation: glaziers, ceiling installers, equipment operators (15%)

Equipment & Site Prep (20% of hard costs):

- Heavy equipment rental: excavators, cranes, lifts (50%)

- Smaller equipment and tools: scaffolding, generators, compressors (30%)

- Site preparation: excavation, grading, temporary utilities (20%)

These percentages shift based on project type. MEP-heavy projects may see materials drop to 30% while labor increases to 50%. Civil projects may see equipment costs rise to 30%, with site prep comprising the majority of that category.

Get Control of Your Time Tracking

Soft Costs in Construction

Soft costs support project completion without creating physical structure. For specialty contractors, these intangible costs often appear as overhead, general conditions, or administrative expenses. While general contractors may track soft costs in detail as project line items, subcontractors still need to understand how these costs affect their operations – particularly for project administration, insurance calculations, and overhead allocation.

Soft costs break down into four primary categories:

Factor

What Drives It

Key Components

Planning & Design

Planning and design costs include fees for architectural services, engineering drawings, and permit applications. For specialty contractors, this typically means permit fees specific to your trade (electrical permits, mechanical permits), plan review fees, and any engineering required for specialty systems. Design and engineering fees occur primarily during pre-construction but may extend into construction when design revisions or field conditions require engineering review.

Financing

Financing costs include loan origination fees, interest accrued during construction, and bank fees for payment processing. While owners typically handle construction financing directly, specialty contractors may carry financing costs for materials purchased in advance, equipment purchases, or cash flow management during payment cycles. Interest on operating lines of credit, equipment loans, and bonding fees fall into this category.

Insurance and Taxes

Insurance and taxes represent ongoing costs throughout the project. Builder’s risk insurance, general liability insurance, and workers’ compensation premiums protect against project risks. Professional liability insurance (errors and omissions) covers claims related to work quality or compliance. Property taxes, permit fees, and local business taxes add to this category. For union contractors, additional soft costs and insurance requirements may apply.

Project Management and Administration

Project management and administration includes salaries for project managers, superintendents, estimators, and office staff supporting the project but not performing physical work. It covers field office rental, trailer setup, temporary facilities, storage costs, and administrative supplies.

Technology costs (project management software subscriptions, devices, communication systems) fall here. Administrative time spent on payroll processing, compliance documentation, and client reporting represents soft costs – time that supports the project without creating billable progress.

How Soft Costs Impact Overall Project Finances

Soft costs impact overall project finances through their timing, predictability, and financing structure. While hard costs are typically financed through milestone-based disbursements tied to construction progress, most soft cost expenses require invoice-based payments that continue throughout pre-construction, construction, and post-construction phases.

The financial impact appears in several ways within the overall construction budget:

Cash flow requirements differ between categories

Hard costs follow construction progress – materials get ordered as needed, labor gets paid weekly or biweekly, equipment rentals align with usage. Soft costs may require upfront payment (building permits, insurance premiums) or recurring monthly payments (financing costs, administrative salaries) regardless of construction progress.

Timeline extensions affect soft costs disproportionately

A project delayed by three months continues to incur financing costs, insurance premiums, and administrative overhead even when construction activity slows. Hard costs may pause during delays – materials stop getting ordered, labor hours decrease – but many soft costs continue accumulating.

Soft costs serve as early indicators of project risk

Extended permit approval timelines signal potential budget pressure. Multiple design iterations compound administrative costs and may delay construction start dates. Inadequate documentation during construction can affect insurance claims and compliance verification, creating costs that appear later in the project lifecycle.

For specialty contractors managing T&M (time and material) projects, soft cost tracking becomes particularly important. Administrative fees spent on documentation, client reporting, and billing backup represent real costs. Projects requiring extensive reporting, compliance documentation, or client coordination carry higher soft cost allocations than straightforward contract work.

Understanding these impacts helps construction companies price work accurately, manage cash flow effectively, and identify projects where soft cost requirements may affect profitability.

Get Control of Your Time Tracking

Commonly Overlooked Soft Costs in Construction Projects

Several soft cost categories often get underestimated or excluded from initial budgets:

Temporary utilities during construction include temporary power service, water connections, and communication systems needed before permanent utilities are operational. Fees for service installation, monthly utility charges, and eventual removal add up over project timelines.

Document management and compliance tracking require time and systems. Creating, organizing, and maintaining project documentation – submittals, RFIs, change orders, daily reports, safety documentation – represents administrative labor. Digital storage, software subscriptions for document management, and time spent responding to information requests all fall into soft costs.

Change order administrative processing consumes time beyond the direct costs of the changed work. Pricing change orders, negotiating with clients, updating schedules, revising material orders, and tracking financial impacts all represent administrative work that doesn’t appear on installation labor reports.

Technology and communication costs include project management software subscriptions, accounting software, time tracking systems, mobile devices, communication services, and IT support. As the construction industry becomes more data-driven, these costs increase while often remaining buried in overhead rather than properly allocated to projects.

Payroll processing and HR administration represent recurring soft costs. Time spent collecting timesheets, resolving discrepancies, processing payroll, managing benefits, and handling onboarding/termination procedures all support the workforce without creating billable progress. Manual payroll processes can consume 10-20 hours per week for companies with 100+ field workers.

Additional soft costs often overlooked include:

- Legal fees for contract review, dispute resolution, or compliance matters

- Accounting expenses for project-specific bookkeeping or audit support

- Marketing expenses for project-specific promotional materials or events

- Landscaping costs for site beautification beyond base site work

Systems that reduce manual processing address soft costs directly. Automated time verification can reduce payroll processing time by approximately 800 hours annually in documented cases – time that can be redirected to revenue-generating activities or eliminated from overhead.

Construction Soft Cost Examples

Here’s how soft costs typically break down as a percentage of total project costs:

Planning & Design (5-8% of total project costs):

- Architectural and engineering fees (60%)

- Building permits and approval fees (25%)

- Geotechnical and environmental studies (15%)

Financing (3-5% of total project costs):

- Construction loan interest (70%)

- Loan origination and processing fees (20%)

- Bond premiums and financing-related insurance (10%)

Insurance & Taxes (4-7% of total project costs):

- General liability and builder’s risk insurance (50%)

- Workers’ compensation insurance (30%)

- Building permits, property taxes, business licenses (20%)

Project Management & Administration (6-10% of total project costs):

- Construction project management and superintendent salaries (50%)

- Administrative staff and office operations (25%)

- Project management software, communication, and temporary facilities (15%)

- Legal fees, accounting expenses, and consulting fees (10%)

Total soft costs typically represent 20-30% of overall project costs. More complex projects with extensive design requirements, stringent compliance standards, or challenging financing structures may see soft costs approach 35% of total project costs.

Get control of your labor costs with verified jobsite data. Book your SmartBarrel demo to see how contractors reduce time variance and improve hard cost accuracy.

Get Control of Your Time Tracking

The Importance of Identifying Hard Costs vs. Soft Costs

Proper cost categorization serves several operational requirements that affect a successful construction project:

Operational Requirement

Hard Cost Implications

Soft Cost Implications

Bidding & Estimation

Accurate bidding and estimation depends on understanding costs across both categories. Hard costs drive the bulk of project pricing – materials, labor, and equipment represent work that clients can see and verify. Underestimating hard costs creates immediate budget pressure.

Soft costs affect total project profitability but may not appear as direct line items on client proposals. Failing to account for soft costs in overhead calculations means profit margins that look healthy on paper but disappear when all expenses are tallied.

Financing & Disbursement

Financing approval and fund disbursement require proper cost categorization as a key component of financial planning. Lenders evaluate construction financing based on how funds will be used. Hard costs are typically disbursed through milestone-based payments tied to construction progress – foundation completion, framing completion, mechanical rough-in, substantial completion.

Soft costs often require different disbursement structures – upfront payments for building permits and design fees, monthly payments for financing costs, invoice-based payments for administrative services.

This distinction affects cash flow planning throughout the building process. Projects with high upfront soft costs require either additional working capital or alternative financing structures. Understanding when costs occur – not just total amounts – determines whether a contractor can maintain positive cash flow throughout the project.

Risk & Contingency

Risk management and contingency planning differ between categories. Hard costs respond primarily to scope changes, material price fluctuations, and productivity variations. Typical hard cost contingencies run 5-10% depending on project complexity and market conditions.

Soft costs respond to timeline extensions, regulatory changes, and project complexity that emerges during construction. Soft cost contingencies typically run 10-20% because these costs are harder to predict and continue accumulating during project delays.

Cost Control & Optimization

Cost control and optimization require category separation. When costs run over budget, identifying whether the overrun stems from hard costs or soft costs determines the response. Hard cost overruns may indicate scope creep, productivity issues, or material cost increases – problems that require field-level intervention.

Soft cost overruns may indicate timeline delays, administrative inefficiencies, or compliance requirements that weren’t fully anticipated – problems that require process improvements or better estimation for future projects.

Accountability

Accountability and process improvement depend on clear cost categorization. Assigning responsibility for cost management becomes clearer when categories are separated. Project managers typically own hard cost control – managing scope, productivity, and field efficiency. Estimators and project executives typically own soft cost control – managing timelines, administrative processes, and regulatory compliance.

The operational challenge isn’t understanding the categories. Most construction professionals grasp the basic distinction. The challenge is establishing measurement systems that capture accurate data for each category.

Material costs flow through documented purchasing systems – purchase orders, receiving tickets, invoices. The data trail exists. Labor costs depend on time capture systems that may introduce variance depending on their design. Administrative time often goes untracked entirely, making soft cost allocation estimates rather than measurements.

Comparing Hard vs. Soft Costs

The operational differences between hard and soft costs extend beyond simple categorization:

Visibility and Tangibility

Hard costs create visible, tangible results. Building materials become structure. Labor hours create measurable progress. Equipment enables specific work to be completed. The connection between expense and output is direct.

Soft costs support the project without creating visible structure. Building permits enable legal construction but don’t appear in the finished building. Financing costs enable project development to proceed but leave no physical trace. Construction project management coordinates work but doesn’t install materials.

Timing and Duration

Hard costs concentrate during active construction. Material orders increase as the building process progresses. Labor hours peak during primary construction phases. Equipment needs align with specific work activities.

Soft costs extend throughout the project lifecycle. Design fees occur during pre-construction. Building permits may be required before construction starts. Financing costs accumulate from loan origination through project completion. Insurance premiums continue monthly. Administrative costs persist from project start through closeout and warranty periods.

Predictability and Variance

Hard costs are quantity-driven and generally more predictable. Material quantities can be estimated from drawings. Labor hours can be projected based on historical productivity. Equipment needs follow from scope and schedule.

Variance in hard costs typically stems from scope changes, material price fluctuations, or productivity differences. These can be substantial but usually have identifiable causes.

Soft costs are influenced by factors outside direct project control. Regulatory approval timelines vary. Financing market conditions change. Design iterations depend on client decisions and field conditions discovered during construction. These factors make soft costs harder to predict with precision.

Impact of Project Changes

Hard costs respond to scope modifications. Adding square footage increases material and labor requirements proportionally. Upgrading specifications increases material costs. Accelerating schedules may increase labor costs through overtime or additional crews.

Soft costs respond to timeline changes and regulatory shifts. Project delays extend financing costs, insurance periods, and administrative overhead. New compliance requirements may trigger additional engineering review or building permit modifications. Design changes during construction increase administrative processing for change orders and documentation updates.

Data Accuracy Requirements

Hard costs depend on verified field quantities and hours. Material costs flow through purchase orders and invoices that provide clear documentation. Labor costs require time capture systems that maintain accuracy – the measurement challenge that affects job costing reliability.

Soft costs require proper invoice tracking and timeline documentation. Building permits, insurance premiums, and professional services get documented through invoices. Administrative time often remains untracked, making soft cost allocation estimates rather than measurements.

Both categories benefit from integrated systems that maintain data quality throughout the project lifecycle. When field data flows directly to cost tracking systems, hard cost accuracy improves. When administrative processes are standardized and measured, soft cost tracking improves.

Managing Soft and Hard Costs

Effective cost management depends on establishing reliable data capture systems and processes that support accuracy across both categories.

Hard Cost Management

Hard cost control requires verification at the source. Material costs flow through documented purchasing systems that create clear audit trails. Equipment costs get tracked through rental agreements and usage logs. Labor costs – representing 40-50% of hard costs – depend on time capture systems that maintain accuracy.

Verified time tracking reduces labor cost variance

Manual timesheets captured from memory at week’s end can introduce 3-5% variance through rounding, recall errors, and delayed entry. Automated time capture with biometric verification addresses these measurement challenges by capturing time at the source with minimal worker burden.

Complete Mechanical, an MEP contractor, reduced payroll processing time by approximately 2.5 days per week through automated time verification. The efficiency gain addresses a soft cost (administrative time) while improving hard cost accuracy (labor hours properly allocated to cost codes).

Material tracking integration supports cost accuracy

When material orders, deliveries, and installations are tracked in connected systems, contractors can monitor material usage against estimates. Variance analysis helps identify waste, theft, or estimation errors that affect future bidding.

Equipment utilization monitoring provides usage data

Understanding actual equipment usage versus rental periods helps optimize equipment decisions. Idle equipment drives costs without creating productivity. Overutilized equipment may justify purchase rather than rental.

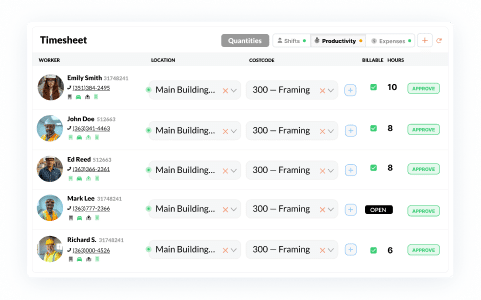

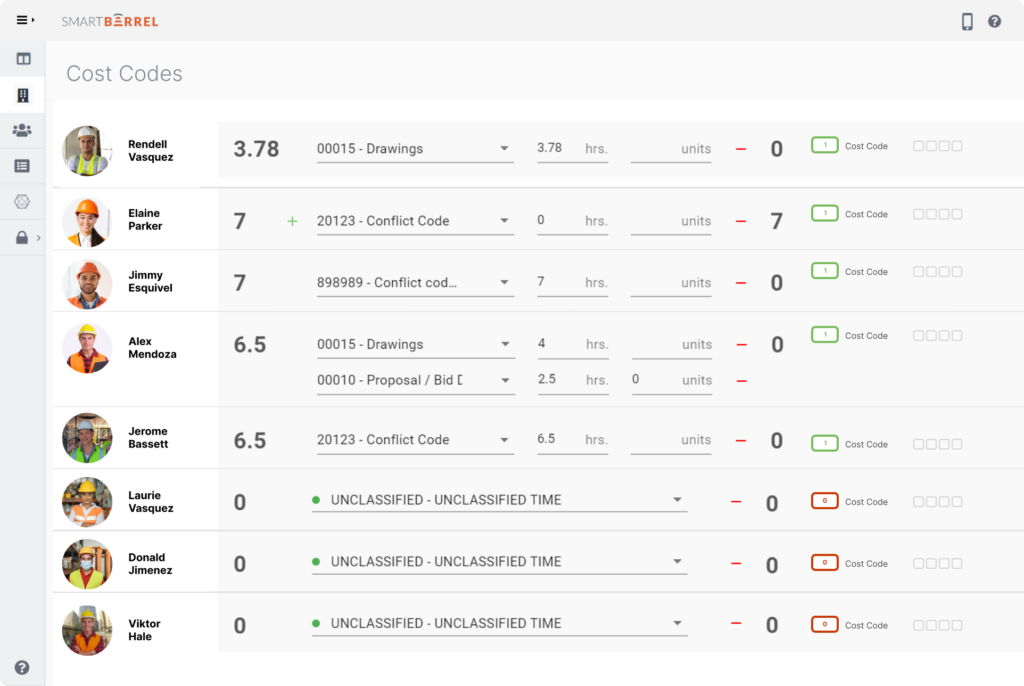

Job costing precision depends on data quality

Cost codes allow detailed tracking, but only when time gets properly allocated. When construction workers check in with verified time tracking, foremen can assign cost codes to pre-populated timesheets rather than creating time entries from scratch. This reduces administrative burden while improving cost code accuracy.

Soft Cost Management

Soft cost control requires tracking expenses that don’t appear on field progress reports.

Administrative time tracking

This (often excluded from initial estimates) quantifies the real cost of project support activities. Time spent on payroll processing, compliance documentation, client reporting, and change order administration represents real costs that should be measured and managed.

Systems that reduce manual processing address these costs directly. Automated payroll workflows, digital document management, and integrated reporting tools reduce the hours required to support field operations.

Document management supports compliance requirements

Organized storage for contracts, building permits, submittals, RFIs, and safety documentation reduces time spent searching for information. It also supports audit readiness and regulatory compliance, reducing risk of penalties or rework.

Accurate time records support insurance calculations

Workers’ compensation premiums are based on payroll by classification code. Accurate time allocation to the right job classifications ensures proper insurance cost allocation and reduces audit adjustments.

For contractors managing T&M billing requirements, verified time data provides documentation that clients accept. When disputes arise over billed hours, facially verified check-in/check-out records with timestamps and location data are harder to challenge than manual timesheet entries.

Integrated Approach to Construction Cost Management

The most effective cost management combines verified field data with proper administrative systems.

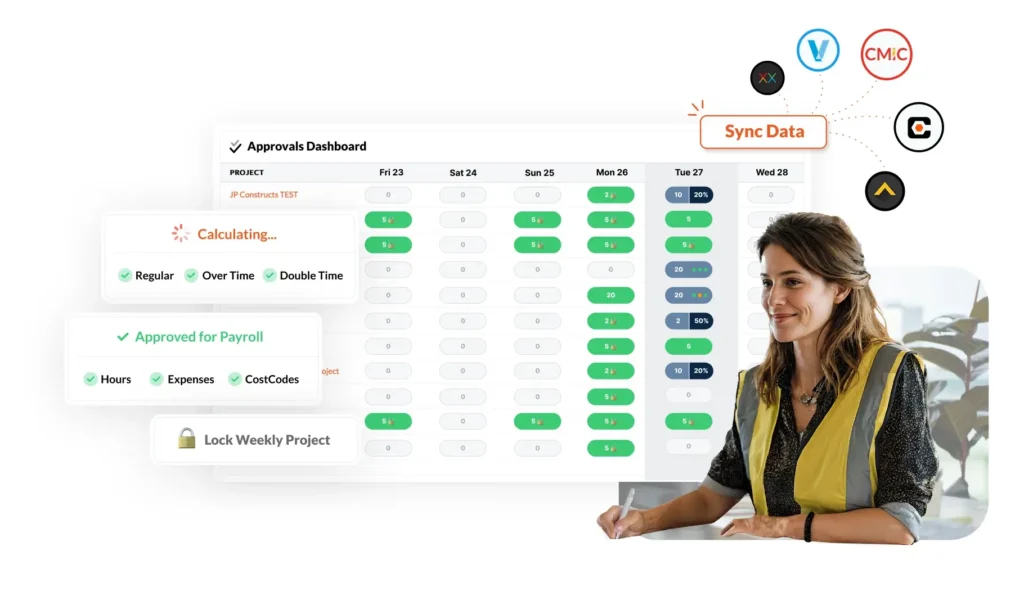

SmartBarrel’s verified time tracking provides the foundation for accurate labor cost data. Construction workers check in using facial verification at jobsite devices or through mobile apps with geo-fencing. Time data flows automatically to the dashboard where foremen assign cost codes. The system handles overtime calculations, prevailing wage requirements, and integration with payroll systems.

This addresses both hard costs (accurate labor hours and cost code allocation) and soft costs (reduced administrative time for payroll processing and dispute resolution).

If per diem is handled ad-hoc, it turns into a recurring soft-cost problem, this primer on per diem policy in construction helps set consistent guardrails.

Integration with ERP and project management software (Procore, Foundation, Viewpoint Vista, CMiC) enables data to flow from field capture through job costing, billing, and financial reporting. When systems connect, manual re-entry gets eliminated, reducing errors and administrative burden.

Real-time data visibility supports proactive cost management rather than reactive problem-solving. When labor hours flow to cost codes in real time, project managers can identify cost overruns while there’s still time to adjust. When administrative processes are measured, managers can identify bottlenecks and inefficiencies before they compound.

Strategies for Effectively Budgeting and Managing Hard Costs

Several foundational practices support accurate hard cost estimation and control:

Review historical data from similar projects

Past performance on comparable work provides the best baseline for estimating labor productivity, material quantities, and equipment needs. This approach depends on the quality of historical data – accurate labor hours and cost code allocation create reliable benchmarks. Inaccurate historical data perpetuates estimation errors.

Implement detailed cost coding systems

Breaking work into specific cost codes (foundation, framing, mechanical rough-in, finish work) enables precise tracking. Detailed cost codes support variance analysis – identifying which activities ran over or under budget and why.

Build category-appropriate contingencies

Hard cost contingencies typically run 5-10% based on project complexity, market conditions, and scope clarity. Higher contingencies make sense for projects with incomplete design, volatile material costs, or challenging construction site conditions.

Track productivity metrics

Understanding actual productivity rates (labor hours per unit of work) improves future estimating. Metrics like “hours per square foot of drywall installed” or “hours per electrical device” provide benchmarks that account for crew experience, site conditions, and coordination challenges.

Monitor material waste rates

Comparing materials ordered versus materials installed identifies waste, theft, or estimation errors. Industry averages provide starting points, but actual project data refines understanding of material requirements.

Account for learning curves on repetitive work

First-time installations of complex systems take longer than subsequent installations. Projects with repetitive elements (hundreds of identical hotel rooms, for example) show productivity improvements as crews develop efficiency.

Historical labor data supports accurate estimation when original time capture maintained data quality. Estimates based on manually entered timesheet data may carry forward the same 3-5% variance that affected the original project.

Stop estimating labor costs with inaccurate historical data. See how verified time tracking creates reliable benchmarks for future bids. Request your SmartBarrel demo.

FAQs

What percentage of construction are soft costs?

Soft costs typically represent 20-30% of total project costs, with hard costs comprising the remaining 70-80%. Complex commercial projects with extensive design requirements or stringent compliance standards can push soft costs to 35% or higher. Simple warehouse or industrial projects with straightforward designs typically fall toward the lower end at 15-20%.

What expenses are excluded from construction hard costs?

Hard costs exclude any expense not directly tied to physical construction—permits, design fees, financing costs, insurance, and project management salaries. Regulatory costs like building permits and legal fees, professional services like architectural and engineering design, and administrative expenses like office rental all fall into soft costs. If it supports the project without creating physical structure, it’s a soft cost.

How do hard and soft costs impact overall construction project budgeting?

Hard costs (70-80% of budget) drive bulk spending and follow construction progress with milestone-based payments, while soft costs (20-30%) require different timing—often upfront or monthly payments regardless of construction pace. This timing difference affects cash flow and working capital requirements throughout the project. Hard costs typically need 5-10% contingencies; soft costs require 10-20% because they’re more susceptible to timeline delays and regulatory changes.

How to accurately estimate soft costs in construction projects?

Break soft costs into categories (design fees, permits, financing, insurance, administration) rather than using a single percentage, and estimate each based on project-specific requirements. Account for project timeline since longer projects carry higher financing costs, extended insurance periods, and more administrative overhead. Build 10-20% contingencies depending on project complexity, and verify regulatory requirements early since permit fees and compliance costs vary significantly by jurisdiction.

Wrap-Up

Understanding hard costs and soft costs provides the framework for construction cost management across the construction industry. The distinction shapes budgeting, financing, risk planning, and cost control strategies. Hard costs create physical structure through building materials, labor, and equipment. Soft costs support project completion through design, regulatory compliance, financing, and administration.

The operational value of this distinction depends on measurement accuracy. Cost categorization provides structure – verified data enables precision. Material costs flow through documented purchasing systems. Labor costs depend on time capture systems that maintain accuracy at the source. Administrative costs often remain unmeasured, making soft cost allocation estimates rather than data.

For specialty contractors managing multiple jobsites and complex workforce structures, labor cost accuracy affects everything from job costing to future estimating. When time variance reaches 3-5% through manual entry and delayed capture, that variance compounds across projects, affecting profit margins and competitive positioning.

Effective cost management combines proper categorization with reliable measurement systems. Understanding the categories provides structure. Verified jobsite data creates the accuracy that turns structure into actionable information.

Cost categorization provides the structure. Data quality determines the accuracy. See how verified jobsite data supports both hard and soft cost management.